We’re Filling the Affordability Gap in Education.

Why Choose Diversified College Planning?

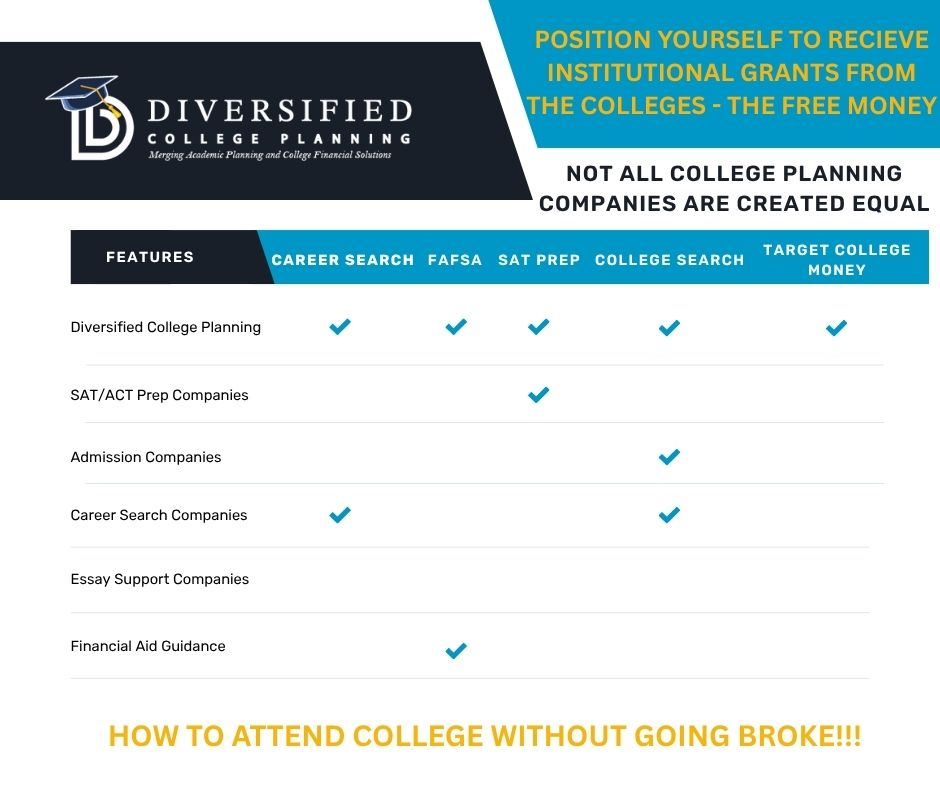

At Diversified College Planning, we saw a gap in the college planning process. Most companies focus only on SAT/ACT prep, admissions, or college selection—but they leave out a key part: how to afford college. We combined our financial and academic expertise to create a complete solution. Our service brings together an academic support center, a college funding expert, and a social media specialist—all in one.

Our Journey: The Diversified College Planning Timeline

A legacy of trust, innovation, and family values—since 1980.

1980

2008

2010

2012

2020

2025

A Message From Our Founders

Rick and Margaret Stolz

Colleges have become highly sophisticated in how they recruit students. What was once called admissions is now known as strategic enrollment management—a system built around data and algorithms designed to increase a school’s revenue, not necessarily to serve the student’s best interests.

Families often approach the college process with hope and good intentions but without a full understanding of how it really works. At Diversified College Planning, we help families see through the noise.

As a family-owned business for over 45 years, we’ve worked with generations of families just like yours. We understand the pressure parents feel to provide opportunities for their children without jeopardizing their financial future. We’ve seen the stress, the uncertainty, and the sacrifices families are asked to make.

That’s why we approach this process as a family helping other families—offering guidance that’s grounded, thoughtful, and always in your best interest.

Thank you for allowing us to be part of your journey. It’s a responsibility—and a relationship—we deeply value.

– Rick Stolz CLU, ChFC, RHU, CLTC, LUTCF

About Us

A Proven Process, and A Team You Can Trust

Many families don’t know where to start with college planning—whether it’s choosing the right school, affording it, or using savings wisely. We help you find the best-fit college, including schools that may actually pay you to attend. With our plan, doors open to colleges you thought were out of reach academically or financially. If you’ve built a college fund, we’ll create a strategy to stretch those savings so you’re not left with a zero or negative balance after graduation. Just like you wouldn’t shop for a house without knowing what you can afford, we help you prequalify for college. Our process includes calculating your Student Aid Index (SAI), seeing if we can lower it, and identifying colleges that offer you the most money. On average, we save families $80,000 with a graduation rate of 95%.

We help you focus on academics, not Economics.

Most families assume their financial advisor will cover college—but the truth is, college funding requires a different playbook. Even the best retirement plan can unravel when college costs aren’t part of the equation.

Navigating the admissions and financial aid landscape takes more than general financial knowledge. It requires deep expertise in FAFSA and CSS Profile strategy, aid formulas, merit-based scholarships, and award negotiation tactics. Do most advisors know how to file an appeal? Analyze competing aid offers? Time asset shifts for maximum eligibility?

With over 6,000 colleges in the U.S.—each with their own process, deadlines, and pricing strategy—you need a guide who lives and breathes college planning. That’s where we come in. At Diversified College Planning, we help families make smarter choices, lower out-of-pocket costs, and avoid mistakes that could cost tens of thousands.

If we don’t believe we can help you than we will tell you up front. We have helped over 30,000 families for 20+ years, we understand colleges market for you, but not for YOUR benefit.

Our Leadership

Experienced Professionals, Committed to You and Your Child’s Success!

Jarad Stolz CRPC, CLTC

Jarad Stolz brings a wealth of experience and insight to Diversified College Planning, where he works closely with families to make college more affordable through smart, personalized financial strategies. With a deep understanding of both financial planning and the inner workings of the college funding system, Jarad helps families reduce out-of-pocket costs without compromising long-term financial stability.

Jarad specializes in college funding strategies that go beyond basic financial aid advice. He helps parents understand how the Student Aid Index (SAI) is calculated and how to legally and strategically lower it to qualify for more need-based aid. His approach includes evaluating financial positioning, helping families restructure assets when appropriate, and identifying schools that are most likely to offer generous merit and institutional aid based on a student’s academic and personal profile.

Through a top-down planning method, Jarad assists families in building a focused college list—starting with over 2,500 schools and narrowing it to those where the student fits in socially, gets in academically, and most importantly, gets paid to attend. His ability to merge admissions strategy with financial strategy allows families to avoid overpaying, reduce debt exposure, and protect retirement savings in the process.

Jarad’s dedication to transparency and individualized planning has helped countless families approach the college process with clarity and confidence. Whether working with first-time applicants or families navigating college for multiple children, Jarad ensures every plan is grounded in logic, driven by data, and designed for long-term success.

Mike Dusombre CRPC, CLTC

Mike Dusombre plays a key role at Diversified College Planning, where he brings a unique combination of financial insight and real-world practicality to the college funding process. With years of experience guiding families through complex financial decisions, Mike focuses on delivering straightforward, effective strategies that reduce the cost of college and protect long-term financial goals.

Mike works with families to simplify every stage of the planning process—from understanding financial aid formulas to evaluating school affordability and building a strategy that aligns with both college and retirement timelines. His approach emphasizes clarity, efficiency, and impact. By helping families lower their Student Aid Index (SAI), uncover merit-based opportunities, and strategically target colleges that offer substantial aid, Mike ensures families don’t just find the right school—they find the right financial fit.

What sets Mike apart is his ability to translate financial strategy into meaningful outcomes for each student and family. He takes the time to understand the full picture—academic goals, household finances, and long-term priorities—then creates a plan that balances them all. Families value his honest, no-fluff communication style and his commitment to helping them make confident, informed decisions in an otherwise overwhelming process.

Through personalized guidance and a data-driven approach, Mike helps families avoid common mistakes, minimize debt, and save tens of thousands of dollars on the true cost of college. His mission is simple: make the path to college more affordable, more strategic, and far less stressful.

Jenelle – Admissions Counselor

Jenelle brings years of admissions experience to the team, offering students valuable insights into what colleges are really looking for. She helps families navigate applications with confidence and ensures every student puts their best foot forward.

Joseph – SAT Prep Coach

Joseph, a standout graduate of our college planning program, went on to earn a degree in Economics from Cornell University. With three years of professional tutoring experience and two additional years of volunteer service, he brings both expertise and passion to every session.

Tutor Space is our in-house test prep platform—created to make elite-level tutoring accessible to all learners at a fraction of the traditional cost. Built on proven learning methodologies developed by our expert team, the platform delivers personalized strategies that help students reach their full potential. Backed by a dedicated group of educators who continually refine and expand its resources, Tutor Space ensures that families benefit from the very best in modern educational support.

Allen – Social Media Coordinator

In 2014, Alan Katzman launched Social Assurity to provide the most comprehensive social media and digital literacy curriculum for college-bound students. Drawing on his extensive background in law, compliance, and technology, Alan has delivered countless lectures nationwide on the evolving role of social media in both college admissions and career development. Based in New York, he dedicates his time to monitoring emerging digital trends and expanding Social Assurity’s educational reach to ensure students are equipped for success in an increasingly connected world.

Theresa – College Search Specialist

Theresa helps families uncover the best-fit colleges for their student—academically, financially, and personally. Her deep knowledge of school profiles and admissions trends brings clarity to an otherwise overwhelming search process.

Why Most College Planning Services Fall Short—And What Sets Us Apart

Get the guidance you need, all in one place—from FAFSA to career fit to maximizing aid.